Residents Association Insurance - Increasing Risk of Claims

A Communities Vision

Residents Associations highlight the strength of a group of people within local communities to make positive change. There have been countless cases where members come together to lead the way in community development.

We believe a strong association should be:

- Responsible

- Accountable

- Democratic

- Representative

These associations are formed to reflect wider interests of local members and are shaped to achieve specific community goals.

Creating Positive Change – Risk or Resolution

Associations can achieve a variety of tasks that can create positive change and benefit local communities, they could:

- Assist the council in tackling social issues such as anti-social behaviour & crime;

- Help protect communities against planned developments;

- Improve the services in the local area;

- Help campaign against issues such as traffic, parking problems or pollution;

- Keep residents informed about issues affecting their estate/area;

- Represent residents’ views to organisations & the local council;

- Organise social, leisure or educational activities for their area or estate;

- Challenge racist, sexist or derogatory remarks.

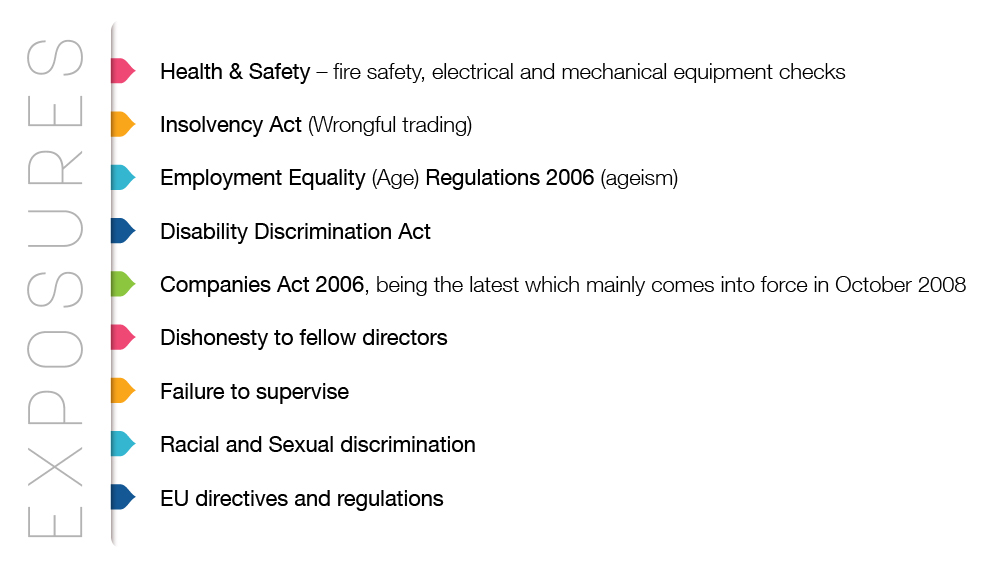

Anyone within a local community can join a Residents Association. The associations have frequent meetings and should encourage involvement from a wide range of social groups, ages and minorities. Such organisations should provide a platform for members of the community to vocalise their point of view and concerns. With added responsibilities members of such organisations expose themselves to the risk of increased claims being made against them. In addition to this rules and regulations hold associations accountable and could expose them to further more serious claims, a few of which are listed below.

Examples of Exposures

We have seen a variety of claims arise over the past twenty years, from management of houses and flats, to maintenance of roads, trees, waste, pollution and discrimination. We understand that associations are there to invest in the community however, by doing so they increase their exposure to legal claims being made against them.

Whether you have formed a residents association, Management Company or Resident Company limited. You should consider the protection of the volunteers, committee members, trustees, officers and chairpersons. All of which could be held accountable and responsible if a claim was to be made against them. The legal costs associated with such could cost thousands of pounds and put their personal property at risk. A few examples of real life claims can be seen below:

Case Study 1

Two Directors of a resident management company were sued for libel by a former Director. Following failure of disclosure of conflicts of interest a Director was removed from the board.

Despite the former Director dropping his libel case after a mediation hearing, over £35,000 of legal costs were incurred under the D&O policy.

Case Study 2

A resident sued the Directors and chairman of a management company when selling their flat for the diminution in the value of the property.

It was alleged the management failed their duty of care in managing an unruly tenant in an adjacent flat.

Legal costs exceeded £10,000.

Why us? Are you covered?

With over 20+ years experience working in the broking industry and as one of the most reliable and credible Brokers in the market, we can provide you with competitive insurance cover from a wide range of reputable insurers.

Our policies can cover you against:

- Wrongful acts

- Libel and slander

- Errors & Omissions

- Safety & Emergency Regulation

- Discrimination

- Dishonesty of fellow directors

Other Insurance to Consider

Alongside your resident’s association insurance policy in order to ensure you are covered to the highest level of protection, we recommend that you consider:

< Back